Card Recommender

Recommended Card(s)

Recommended Line of Credit

Thank you for your selections, your recommended card(s) as follows:

Your recommended line of credit as follows:

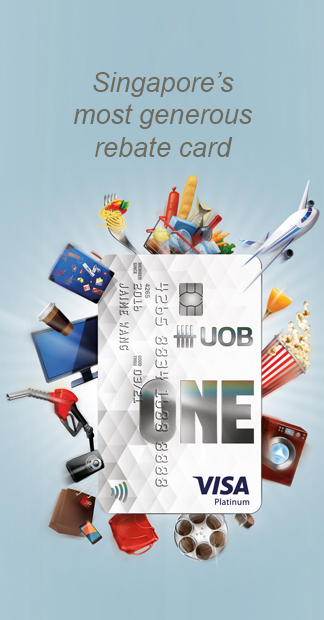

UOB One Card

Description

Up to 5% cash rebate on all spend

Benefits

Up to 5%1 cash rebate on all spend (Up to 3.33% rebate for spend below S$2,000)

- Earn up to S$1,200 cash rebate per year on everything you buy – including 0% Instalment Payment Plan (0% IPP) and recurring bill payments.

|

Spend

S$500, S$1,000 or S$2,000

per statement month (min 3 purchases) |

3 months

consecutively

|

Get cash rebate

S$50, S$100 or S$300

respectively per quarter |

Petrol Savings

- Save up to 24% at SPC2

Additional rebate with SMART$ Rebate Programme

- On top of your UOB One Card cash rebate, you can also enjoy up to 10% SMART$ rebate at over 900 participating merchants islandwide.

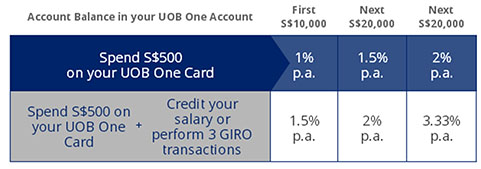

Up to 3.33% p.a.3 deposit interest rate on UOB One Account4

- Enjoy up to 3.33% interest p.a. on savings in UOB One Account with S$500 minimum spend every calendar month on your UOB One Card.

Terms and Conditions

Singapore's Most Generous Rebate Card refers to the highest cash rebate of 5% based on a retail spend amount of $2,000 per month for 3 consecutive months, in comparison to other banks cash rebate cards across Singapore as of 1 Dec 2015. Please note that exclusions apply.

1Enjoy up to 3.33% cash rebate based on a spend of S$500 or S$1,000 monthly for each qualifying quarter with min. 3 purchases monthly to earn the quarterly cash rebate of S$50 or S$100 respectively. Enjoy up to 5% cash rebate based on a spend of S$2,000 monthly for each qualifying quarter with min. 3 purchases monthly to earn the quarterly cash rebate of S$300. Each qualifying quarter consists of 3 consecutive statement periods. Please refer to full set of UOB One Visa Credit Card Terms and Conditions and FAQs at uob.com.sg/one.

2 Visit uob.com.sg/fuelpower for details.

3 Maximum effective interest rate (EIR) on the One Account is 1.60% p.a. for deposits of S$50,000, provided customers meet the criteria of S$500 Card Spend. Maximum effective interest rate (EIR) on the One Account is 2.43% p.a. for deposits of S$50,000, provided customers meet both criteria of S$500 Card Spend and S$2,000 salary credit (you will need to credit your monthly salary of minimum S$2,000 via GIRO) or 3 GIRO debits in each calendar month. Visit uob.com.sg/oneaccount for the full set of Terms and Conditions.

4 Deposit Insurance Scheme: Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$50,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Minimum Sum Scheme are aggregated and separately insured up to S$50,000 for each depositor per Scheme member.

1Enjoy up to 3.33% cash rebate based on a spend of S$500 or S$1,000 monthly for each qualifying quarter with min. 3 purchases monthly to earn the quarterly cash rebate of S$50 or S$100 respectively. Enjoy up to 5% cash rebate based on a spend of S$2,000 monthly for each qualifying quarter with min. 3 purchases monthly to earn the quarterly cash rebate of S$300. Each qualifying quarter consists of 3 consecutive statement periods. Please refer to full set of UOB One Visa Credit Card Terms and Conditions and FAQs at uob.com.sg/one.

2 Visit uob.com.sg/fuelpower for details.

3 Maximum effective interest rate (EIR) on the One Account is 1.60% p.a. for deposits of S$50,000, provided customers meet the criteria of S$500 Card Spend. Maximum effective interest rate (EIR) on the One Account is 2.43% p.a. for deposits of S$50,000, provided customers meet both criteria of S$500 Card Spend and S$2,000 salary credit (you will need to credit your monthly salary of minimum S$2,000 via GIRO) or 3 GIRO debits in each calendar month. Visit uob.com.sg/oneaccount for the full set of Terms and Conditions.

4 Deposit Insurance Scheme: Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$50,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Minimum Sum Scheme are aggregated and separately insured up to S$50,000 for each depositor per Scheme member.

How it works

Here's how to earn maximum cash rebate plus other card privileges with S$2,000 monthly spend:

| Item | Monthly amount | Benefits |

| Mobile and broadband bills | S$200 | Enjoy rebates with recurring bill payments. |

| Petrol | S$400 | Up to 24% petrol savings at SPC |

| Dining | S$400 | Up to 50% off with UOB Dining Privileges |

| Groceries | S$450 | Additional 0.5% SMART$ rebate at Cold Storage, Market Place, Jasons, Giant |

| 0% IPP at Gain City | S$300 | Enjoy rebates with monthly installments |

| Supplementary Card spend | S$250 | Earn rebates with supplementary card spend |

| Total monthly spend | S$2,000 | Earn S$1,200 cash rebate with your UOB One Card in a year and up to 3.33% interest p.a on savings in UOB One Account4 |

UOB Lady's Card

Description

5X UNI$ on shopping and taxi rides

Benefits

5X UNI$ on shopping at local departmental stores, overseas, online shops and taxi rides

UOB Lady's LuxePay Plan - 6 or 12-month installment plan with no interest or processing fees

Complimentary:

- Weekend parking at 313@somerset, Forum The Shopping Mall, Paragon and Scotts Square

- e-Commerce protection for online purchases up to USD200

- Bottle of wine when you dine in Singapore, Hong Kong and China

Terms and conditions apply for benefits and privileges. Visit UOBLadys.com/sg for details.

How it works

| Spend Category in a Statement | Amount Spent |

UNI$ Earned |

| Dining in SG | S$500 | 100 |

| Shopping at SG Metro | S$525 | 525 |

| Taxi Rides in SG | S$100 | 100 |

| Shopping in Hong Kong | S$2,850 | 2,850 |

| Total | S$3,975 | 3,575 |

Other Privileges:

- SMART$ rebates at over 900 outlets like Cold Storage, Guardian, Cathay Cineplexes, The Coffee Bean & Tea Leaf and more

UOB PRVI Miles Visa Card

Description

Up to 6 miles for every S$1 spent

Benefits

Highest local and overseas earn rate with no minimum spend and cap on miles earned

- 6 miles1 on every S$1 spent on major airlines and hotels at Expedia, Agoda and UOB Travel

- 2.4 miles2 on every S$1 spent overseas

- 1.4 miles2 on every S$1 spent locally

Redeem anything

- Enjoy total freedom in choosing your desired rewards such as miles, cash, travel packages or vouchers. Click here for more details.

PRVI Travel Butler

- Allow our travel butler to provide personalised travel advice and assistance on booking of flights, hotels and other travel needs. Simply call 6302 5993 and let our travel butler take care of everything3.

Travel Insurance Coverage

- Charge your travel tickets to your UOB PRVI Miles Visa Card and receive insurance coverage4 of up to S$1,000,000. Click here for the Travel Insurance Certificate.

Terms and Conditions

“Most miles. All the time”/“Fastest miles earn rate” is based on the miles earn rates for local and overseas spend, in comparison to other credit cards in Singapore as of 20 June 2017.

16 Miles

For every S$1 spent on hotel and airline bookings with Expedia . Valid for bookings from 1 April 2017 to 31 March 2018 for travel dates between 1 April 2017 to 30 June 2018 (both dates inclusive). UOB PRVI Miles Cardmembers will earn UNI$15 for every S$5 spent (equivalent to 6 miles for every S$1 spent) on Qualifying Transactions. ""Qualifying Transactions"" refers to transactions at Expedia.com.sg/prvimiles, by a UOB PRVI Miles Cardmember when he/she pays directly to Expedia, on bookings of (a) hotels-only; or (b) flight-only or flight and hotel package booking, where Expedia is the Merchant of Record for the flight booking on participating airlines (including Air Astana, Air India LTD., Air Macau Company, Air Mauritius, Air Niugini, Bangkok Airways, Cathay Pacific, China Eastern Airlines, China Southern Airlines, Finnair, Garuda Indonesia, Gulf Air, Korean Air, Lao Airlines, Latam Airlines Group, Myanmar International Airways, Qatar Airways, SilkAir, Thai Airways Intl, Turkish Airlines, Xiamen Airlines). UOB and merchants reserve the right at any time and from time to time at its sole and absolute discretion to vary, amend, add or delete the above list of participating airlines. The rate of UNI$15 for every S$5 spend on Qualifying Transactions comprises of prevailing earn rate on: (i) local spend (UNI$3.5 for every S$5 spent) and bonus earn rate of UNI$11.5 for every S$5 spent; or (ii) overseas spend (UNI$6 for every S$5 spent) and bonus earn rate of UNI$9 for every S$5 spent, depending on the currency and payment gateway effected on the Qualifying Transactions. The additional UNI$ is not valid in conjunction with other promotions.

For every S$1 spent on hotel bookings with Agoda. Valid for bookings from 26 May 2017 to 31 December 2017 and for stay between 26 May 2017 to 31 March 2018 (both dates inclusive), Cardmembers will earn UNI$15 for every S$5 spent (equivalent to 6 miles for every S$1 spent) at agoda.com/prvimiles for eligible hotel bookings. The rate of UNI$15 for every S$5 spend on Qualifying Transactions comprises of prevailing earn rate on: (i) local spend (UNI$3.5 for every S$5 spent) and bonus earn rate of UNI$11.5 for every S$5 spent; or (ii) overseas spend (UNI$6 for every S$5 spent) and bonus earn rate of UNI$9 for every S$5 spent, depending on the currency and payment gateway effected on the Qualifying Transactions. To have an eligible “Qualifying Transaction”, Cardmembers must: (a) make booking via the dedicated landing page at agoda.com/prvimiles for hotel bookings that have the ""Promotion Eligible"" banner on the search results page; (b) settle payment with their UOB PRVI Miles Card of which Agoda is the party receiving and handling the payment from the Cardmembers; (c) enter Cardmember's NRIC/Passport No. at the payment page; and (d) complete the hotel stay. The additional UNI$ will be credited to Cardmember's credit card account within three months from Cardmember's departure from hotel. The additional UNI$ is not valid in conjunction with other promotions.

For every S$1 spent on airline bookings with UOB Travel. Valid for bookings from 26 May 2017 to 31 December 2017. UOB PRVI Miles Cardmembers will earn UNI$15 for every S$5 spent (equivalent to 6 miles for every S$1 spent) on Qualifying Transactions. ""Qualifying Transactions"" refers to transactions at uobtravel.com/prvimiles on bookings of hotels and participating airlines for travel originating out of Singapore only (including Air China, Air France, All Nippon Airways, American Airlines, Asiana Airlines, British Airways, Cathay Pacific, China Eastern Airlines, Delta Airlines, Emirates, Etihad, Japan Airlines, Jet Airways, KLM Royal Dutch Airlines, Korean Air, Lufthansa, Qantas, Qatar Airways, SWISS International Airlines, Thai Airways International, United Airlines). UOB and merchants reserve the right at any time and from time to time at its sole and absolute discretion to vary, amend, add or delete the above list of participating airlines. The rate of UNI$15 for every S$5 spend on Qualifying Transactions comprises of the prevailing earn rate on local spend of UNI$3.5 for every S$5 spent and bonus earn rate of UNI$11.5 for every S$5 spent. The additional UNI$ is not valid in conjunction with other promotions.

2Miles earn rate

UOB PRVI Miles Cardmembers will earn UNI$ for spend on their UOB PRVI Miles Card. UNI$ will not be awarded on transactions at SMART$ merchants where SMART$ are issued except for UOB PRVI Miles American Express Cardmembers. UOB PRVI Miles Cardmembers will earn UNI$6 for every S$5 spent on transactions in foreign currencies (equivalent to 2.4 miles for every S$1 spent), where the payment gateway is outside of Singapore, and UNI$3.5 for every S$5 spent on transactions in Singapore Dollars (equivalent to 1.4 miles for every S$1 spent). UNI$ will not be awarded for 0% Installment Payment Plans, balance/funds transfers, cash advances, fees, interests, finance charges, late payment charges, annual fee charges, reversals, other financial charges and any other transactions we may exclude from time to time without prior notice.UOB PRVI Miles World Mastercard and PRVI Miles Visa Cardmembers will also not earn UNI$ for bill payment establishments registered under the MCC of 6300 (Insurance Underwriting, Premiums) and 6399 (Insurance – Default), bill payment with transaction descriptions “AXS Payment” and payment of funds to prepaid accounts with transaction descriptions "EZ Link", "FlashPay ATU", "MB * MONEYBOOKERS.COM", "OANDA ASIA PAC", "PAYPAL * BIZCONSULTA", "PAYPAL * OANDAASIAPA", "PAYPAL * CAPITALROYA", "Saxo Cap Mkts Pts Ltd", "SKR*SKRILL.COM", "TRANSIT LINK" and "WWW.IGMARKETS.COM.SG". Click here for details.

3 Operating hours: Monday to Friday (8.30am to 7pm) and Saturday (8.30am to 2pm).

4 Cardmembers must charge the entire fare of the public conveyance in advance of the scheduled departure time to the UOB PRVI Miles Visa Card.

16 Miles

For every S$1 spent on hotel and airline bookings with Expedia . Valid for bookings from 1 April 2017 to 31 March 2018 for travel dates between 1 April 2017 to 30 June 2018 (both dates inclusive). UOB PRVI Miles Cardmembers will earn UNI$15 for every S$5 spent (equivalent to 6 miles for every S$1 spent) on Qualifying Transactions. ""Qualifying Transactions"" refers to transactions at Expedia.com.sg/prvimiles, by a UOB PRVI Miles Cardmember when he/she pays directly to Expedia, on bookings of (a) hotels-only; or (b) flight-only or flight and hotel package booking, where Expedia is the Merchant of Record for the flight booking on participating airlines (including Air Astana, Air India LTD., Air Macau Company, Air Mauritius, Air Niugini, Bangkok Airways, Cathay Pacific, China Eastern Airlines, China Southern Airlines, Finnair, Garuda Indonesia, Gulf Air, Korean Air, Lao Airlines, Latam Airlines Group, Myanmar International Airways, Qatar Airways, SilkAir, Thai Airways Intl, Turkish Airlines, Xiamen Airlines). UOB and merchants reserve the right at any time and from time to time at its sole and absolute discretion to vary, amend, add or delete the above list of participating airlines. The rate of UNI$15 for every S$5 spend on Qualifying Transactions comprises of prevailing earn rate on: (i) local spend (UNI$3.5 for every S$5 spent) and bonus earn rate of UNI$11.5 for every S$5 spent; or (ii) overseas spend (UNI$6 for every S$5 spent) and bonus earn rate of UNI$9 for every S$5 spent, depending on the currency and payment gateway effected on the Qualifying Transactions. The additional UNI$ is not valid in conjunction with other promotions.

For every S$1 spent on hotel bookings with Agoda. Valid for bookings from 26 May 2017 to 31 December 2017 and for stay between 26 May 2017 to 31 March 2018 (both dates inclusive), Cardmembers will earn UNI$15 for every S$5 spent (equivalent to 6 miles for every S$1 spent) at agoda.com/prvimiles for eligible hotel bookings. The rate of UNI$15 for every S$5 spend on Qualifying Transactions comprises of prevailing earn rate on: (i) local spend (UNI$3.5 for every S$5 spent) and bonus earn rate of UNI$11.5 for every S$5 spent; or (ii) overseas spend (UNI$6 for every S$5 spent) and bonus earn rate of UNI$9 for every S$5 spent, depending on the currency and payment gateway effected on the Qualifying Transactions. To have an eligible “Qualifying Transaction”, Cardmembers must: (a) make booking via the dedicated landing page at agoda.com/prvimiles for hotel bookings that have the ""Promotion Eligible"" banner on the search results page; (b) settle payment with their UOB PRVI Miles Card of which Agoda is the party receiving and handling the payment from the Cardmembers; (c) enter Cardmember's NRIC/Passport No. at the payment page; and (d) complete the hotel stay. The additional UNI$ will be credited to Cardmember's credit card account within three months from Cardmember's departure from hotel. The additional UNI$ is not valid in conjunction with other promotions.

For every S$1 spent on airline bookings with UOB Travel. Valid for bookings from 26 May 2017 to 31 December 2017. UOB PRVI Miles Cardmembers will earn UNI$15 for every S$5 spent (equivalent to 6 miles for every S$1 spent) on Qualifying Transactions. ""Qualifying Transactions"" refers to transactions at uobtravel.com/prvimiles on bookings of hotels and participating airlines for travel originating out of Singapore only (including Air China, Air France, All Nippon Airways, American Airlines, Asiana Airlines, British Airways, Cathay Pacific, China Eastern Airlines, Delta Airlines, Emirates, Etihad, Japan Airlines, Jet Airways, KLM Royal Dutch Airlines, Korean Air, Lufthansa, Qantas, Qatar Airways, SWISS International Airlines, Thai Airways International, United Airlines). UOB and merchants reserve the right at any time and from time to time at its sole and absolute discretion to vary, amend, add or delete the above list of participating airlines. The rate of UNI$15 for every S$5 spend on Qualifying Transactions comprises of the prevailing earn rate on local spend of UNI$3.5 for every S$5 spent and bonus earn rate of UNI$11.5 for every S$5 spent. The additional UNI$ is not valid in conjunction with other promotions.

2Miles earn rate

UOB PRVI Miles Cardmembers will earn UNI$ for spend on their UOB PRVI Miles Card. UNI$ will not be awarded on transactions at SMART$ merchants where SMART$ are issued except for UOB PRVI Miles American Express Cardmembers. UOB PRVI Miles Cardmembers will earn UNI$6 for every S$5 spent on transactions in foreign currencies (equivalent to 2.4 miles for every S$1 spent), where the payment gateway is outside of Singapore, and UNI$3.5 for every S$5 spent on transactions in Singapore Dollars (equivalent to 1.4 miles for every S$1 spent). UNI$ will not be awarded for 0% Installment Payment Plans, balance/funds transfers, cash advances, fees, interests, finance charges, late payment charges, annual fee charges, reversals, other financial charges and any other transactions we may exclude from time to time without prior notice.UOB PRVI Miles World Mastercard and PRVI Miles Visa Cardmembers will also not earn UNI$ for bill payment establishments registered under the MCC of 6300 (Insurance Underwriting, Premiums) and 6399 (Insurance – Default), bill payment with transaction descriptions “AXS Payment” and payment of funds to prepaid accounts with transaction descriptions "EZ Link", "FlashPay ATU", "MB * MONEYBOOKERS.COM", "OANDA ASIA PAC", "PAYPAL * BIZCONSULTA", "PAYPAL * OANDAASIAPA", "PAYPAL * CAPITALROYA", "Saxo Cap Mkts Pts Ltd", "SKR*SKRILL.COM", "TRANSIT LINK" and "WWW.IGMARKETS.COM.SG". Click here for details.

3 Operating hours: Monday to Friday (8.30am to 7pm) and Saturday (8.30am to 2pm).

4 Cardmembers must charge the entire fare of the public conveyance in advance of the scheduled departure time to the UOB PRVI Miles Visa Card.

How it works

See how easy you can get a free flight to your next destination

| Earn rate | Monthly spend | Total spend in a year | Miles earned | |

| Air tickets and hotel bookings (booked through Expedia, Agoda and UOB Travel) | S$1 = 6 miles | S$1,200 | 7,200 | |

| Overseas Spend (including online transactions in foreign currencies) |

S$1 = 2.4 miles | $100 | S$1,200 | 2,880 |

| Local spend | S$1 = 1.4 miles | S$1,800 | S$21,600 | 30,240 |

| Total | S$24,000 | 40,320 |

With 40,320 miles, you can redeem a round-trip ticket to Perth, Shanghai, Taiwan or Hong Kong within a year5!

5Redemption of air miles and spend figures are for illustration purposes only. Air ticket redemption is based on economy class tickets and excludes any insurance, airport taxes or any departure surcharges imposed by respective airport authorities.

UOB Delight Credit Card

Description

Get up to 8% rebate and 10% off house brands at grocery, health and beauty stores, as well as up to 3% rebate on contactless transactions and recurring bills.

Benefits

Up to 8% rebate on grocery and health & beauty

- Get 8% rebate at Cold Storage, Market Place, Jasons, Giant and Guardian with S$800 min. spend per month or 3% rebate with S$400 min. spend per month (Min. spend is based on all transactions at any merchants)

10% off house brands

- Enjoy exclusive 10% off house brands^ at Cold Storage, Giant and Guardian

3% rebate on all contactless transactions

- Get 3% rebate on all Visa payWave transactions and NETS FlashPay Auto Top-ups for public transport

3% rebate on recurring bills

- Get 3% rebate on recurring bills for all telcos, Prudential Insurance and United Overseas Insurance, Town Councils and newspapers

0.3% rebate will be awarded for all Cold Storage, Market Place, Jasons, Giant, and Guardian, Visa payWave, NETS FlashPay Auto Top-up and recurring bill transactions and all other spend if a minimum spend of S$400 per calendar month is not met. All rebates are issued in the form of SMART$. ^Not valid for online transactions and promotional house brand items. Other terms and conditions apply to all featured privileges. Visit uob.com.sg/delight for details.

How it works

Save up to S$600 per year!

| Merchants | Monthly spend in a calendar month | Rebate | Savings in SMART$

(1 SMART$ = S$1) |

| Cold Storage/ Market Place/ Jasons/ Giant/ Guardian | S$500 | 8% | S$40 |

| Purchases made via Visa payWave | S$150 | 3% | S$4.50 |

| MRT & Public Bus payment via NETS FlashPay Auto Top-up | S$100 | 3% | S$3.00 |

| Telco bill | S$50 | 3% | S$1.50 |

| Others | S$100 | 0.3% | S$0.30 |

| Total spend | S$900 | Monthly savings | S$49.30 |

| Yearly savings | S$591.60 |

Table is for illustration purposes only.

0.3% rebate will be awarded for all Cold Storage, Market Place, Jasons, Giant, and Guardian, Visa payWave, NETS FlashPay Auto Top-up and recurring bill transactions and all other spend if a minimum spend of S$400 per calendar month is not met.

Rebate is capped at 50 SMART$ per month.

0.3% rebate will be awarded for all Cold Storage, Market Place, Jasons, Giant, and Guardian, Visa payWave, NETS FlashPay Auto Top-up and recurring bill transactions and all other spend if a minimum spend of S$400 per calendar month is not met.

Rebate is capped at 50 SMART$ per month.

UOB YOLO

Description

Eat. Drink. Play. Repeat. Because You Only Live Once.

Benefits

Up to 8% rebate1 on Grab, Dining and Entertainment (local & overseas)

3% rebate on Online Fashion and Travel2

Up to 10% SMART$ rebate at over 900 participating merchants outlets3

Up to 13%4 off at Expedia, agoda and more, Free Travel Insurance Coverage (Up to S$500,000)5

Kickstart your investment journey with the Young Professionals Solution.

Terms and Conditions

1 To earn your additional cash rebate (8% and 3%), a minimum spend of S$600 per statement month is required. Total rebate is capped at S$60 per month. If the minimum qualifying spend of S$600 is not met, Cardmembers will earn 0.3% rebate on all spend. Exclusions and other terms and conditions apply.

2 Travel means the Online Card Transaction(s) made at www.agoda.com, www.airasia.com, www.airbnb.com, www.cathaypacific.com, www.expedia.com, www.hotels.com, www.jetstar.com, www.flyscoot.com, www.singaporeair.com, www.tigerair.com, www.uobtravel.com via the internet.

3 Visit uob.com.sg/smart for the full list of merchants.

4 Computation of 13% rebate is based on 10% off hotel bookings from www.expedia.com.sg/uob and 3% cash rebate earned for Online Travel transactions made using UOB YOLO, subject to a minimum monthly spend of S$600.

5 Cardmembers must charge entire fare of the public conveyance in advance of the scheduled departure time to the UOB YOLO to enjoy free travel insurance of up to S$500,000.

Terms and conditions apply for all featured benefits and privileges. Visit uob.com.sg/yolo for details.

2 Travel means the Online Card Transaction(s) made at www.agoda.com, www.airasia.com, www.airbnb.com, www.cathaypacific.com, www.expedia.com, www.hotels.com, www.jetstar.com, www.flyscoot.com, www.singaporeair.com, www.tigerair.com, www.uobtravel.com via the internet.

3 Visit uob.com.sg/smart for the full list of merchants.

4 Computation of 13% rebate is based on 10% off hotel bookings from www.expedia.com.sg/uob and 3% cash rebate earned for Online Travel transactions made using UOB YOLO, subject to a minimum monthly spend of S$600.

5 Cardmembers must charge entire fare of the public conveyance in advance of the scheduled departure time to the UOB YOLO to enjoy free travel insurance of up to S$500,000.

Terms and conditions apply for all featured benefits and privileges. Visit uob.com.sg/yolo for details.

How it works

Earn up to $720 per year!

| MCC Spend Category | Weekday / weekend * | Total spend in a statement month | Rebate Earned | Rebate Amount |

| Dining | Weekend | S$300 | 8% | S$24 |

| Dining (overseas) | Weekend | S$100 | 8% | S$8 |

| Entertainment (local) | Weekend | S$100 | 8% | S$8 |

| Entertainment (overseas) | Weekday | S$100 | 3% | S$3 |

| Online Fashion | Weekday | S$100 | 3% | S$3 |

| Online Travel (selected merchants) | Weekend | S$500 | 3% | S$15 |

| Grocery | Weekend | S$200 | 0.3% | S$0.60 |

| Total spend | S$1400 | Monthly rebate | S$60 |

Qualifying period: Every month based on statement cycle.

The monthly cash rebate are awarded based on posted transactions and monthly cash rebate is capped at $60.

"Weekend" means 0000 Hour on Saturday to 2359 Hour on Sunday and "Weekday" means 0000 Hour on Monday to 2359 Hour on Friday. (Local Time of the city where the Card Transaction was effected)

The monthly cash rebate are awarded based on posted transactions and monthly cash rebate is capped at $60.

"Weekend" means 0000 Hour on Saturday to 2359 Hour on Sunday and "Weekday" means 0000 Hour on Monday to 2359 Hour on Friday. (Local Time of the city where the Card Transaction was effected)

UOB CashPlus

Description

UOB CashPlus is you plus a dream vacation, a happier wedding, or a more affordable way to pay off your credit card bills.

Benefits

Standby line of credit for any purposes.

Get cash up to 6X your monthly income

- Capped at S$200,000, on top of your UOB credit card.

24/7 access to extra cash

- 1.5% cash rebate on your purchases with UOB CashPlus Visa Card

- Complimentary cheque book

- More than 1,200 ATMs locally and 2 million VISA Plus ATMs worldwide

- Internet and mobile banking

Low prevailing interest rate at 19.8% p.a.

Low monthly minimum payment at 2.5% of your outstanding balance

Access to short term financing of 6 months at low interest rate with Funds Transfer

Fixed repayment with Personal Loan (Loan tenor of 1 to 5 years)

No collateral or guarantor required.

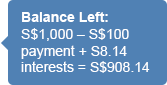

How it works

Illustration of interest charges at 19.8% p.a. – Daily interest as low as S$0.50 per day

|

1

Jun

|

S$1,000 cheque issued

|

||

|

15

Jun

|

S$100 payment made

Interests payable: S$8.14 S$1,000 x 19.8% p.a./ 365 days x 15 days

|

|

|

|

27

Jun

|

Full payment made

Interests payable: S$5.90 S$908.14 x 19.8% p.a./ 365 days x 12 days

|